Automated Teller Machines (ATMs) are very convenient methods of getting cash and making deposits. However, they can pose a safety hazard when criminals use them as a method to steal from unsuspecting victims. You can avoid becoming a victim with some common sense and forward planning.

What We Do

PIN Based Access:

Members are assigned their own personal identification number (PIN) in order to access their account from an ATM.

Daily Limits

Debit and Credit Cards are subject to daily withdrawal or purchase limits to protect accounts. Contact us to find out your limit.

ATM Security

Truity locations follow best practices in ATM hardware security, including up-to-date monitoring systems.

What We Do

PIN Based Access:

Members are assigned their own personal identification number (PIN) in order to access their account from an ATM.

Daily Limits

Debit and Credit Cards are subject to daily withdrawal or purchase limits to protect accounts. Contact us to find out your limit.

ATM Security

Truity locations follow best practices in ATM hardware security, including up-to-date monitoring systems.

What We Do

PIN Based Access:

Members are assigned their own personal identification number (PIN) in order to access their account from an ATM.

Daily Limits

Debit and Credit Cards are subject to daily withdrawal or purchase limits to protect accounts. Contact us to find out your limit.

ATM Security

Truity locations follow best practices in ATM hardware security, including up-to-date monitoring systems.

What We Do

PIN Based Access, Daily Limits, & ATM Security

What We Do

PIN Based Access:

Members are assigned their own personal identification number (PIN) in order to access their account from an ATM.

Daily Limits

Debit and Credit Cards are subject to daily withdrawal or purchase limits to protect accounts. Contact us to find out your limit.

ATM Security

Truity locations follow best practices in ATM hardware security, including up-to-date monitoring systems.

What You Can Do

Pre-plan your cash needs

Stop at a Truity location to withdraw cash or choose the debit option and cash back when purchasing items at a merchant (choose "Debit" instead of "Credit" as your purchase option).

Reduce your risk at ATMs

- Immediately report all crimes to the automated teller machine operator/owner and to the local law enforcement officials.

- Immediately report a lost or stolen card.

- Be aware of your surroundings and listen to your gut. If the ATM is poorly lit or in a concealed location, or if you're just not feeling comfortable, use another machine. Avoid counting cash or rummaging through personal items while standing at the ATM.

- Guard your PIN. Memorize it and never write it down. Cover the keypad when you enter your PIN, and if you notice suspicious activity, cancel your transaction. You should also take your receipt with you, as it may contain personal information that could be helpful to identity thieves.

- When using a drive-through ATM, lock car doors and roll up other windows. If you walk up to the ATM, don't leave your car running or unlocked. And never leave ATM or other credit cards in your car's glove compartment.

- When using an indoor ATM that requires your card for access, avoid letting unknown people in with you.

What You Can Do

Pre-plan your cash needs

Stop at a Truity location to withdraw cash or choose the debit option and cash back when purchasing items at a merchant (choose "Debit" instead of "Credit" as your purchase option).

Reduce your risk at ATMs

- Immediately report all crimes to the automated teller machine operator/owner and to the local law enforcement officials.

- Immediately report a lost or stolen card.

- Be aware of your surroundings and listen to your gut. If the ATM is poorly lit or in a concealed location, or if you're just not feeling comfortable, use another machine. Avoid counting cash or rummaging through personal items while standing at the ATM.

- Guard your PIN. Memorize it and never write it down. Cover the keypad when you enter your PIN, and if you notice suspicious activity, cancel your transaction. You should also take your receipt with you, as it may contain personal information that could be helpful to identity thieves.

- When using a drive-through ATM, lock car doors and roll up other windows. If you walk up to the ATM, don't leave your car running or unlocked. And never leave ATM or other credit cards in your car's glove compartment.

- When using an indoor ATM that requires your card for access, avoid letting unknown people in with you.

What You Can Do

Pre-plan your cash needs

Stop at a Truity location to withdraw cash or choose the debit option and cash back when purchasing items at a merchant (choose "Debit" instead of "Credit" as your purchase option).

Reduce your risk at ATMs

- Immediately report all crimes to the automated teller machine operator/owner and to the local law enforcement officials.

- Immediately report a lost or stolen card.

- Be aware of your surroundings and listen to your gut. If the ATM is poorly lit or in a concealed location, or if you're just not feeling comfortable, use another machine. Avoid counting cash or rummaging through personal items while standing at the ATM.

- Guard your PIN. Memorize it and never write it down. Cover the keypad when you enter your PIN, and if you notice suspicious activity, cancel your transaction. You should also take your receipt with you, as it may contain personal information that could be helpful to identity thieves.

- When using a drive-through ATM, lock car doors and roll up other windows. If you walk up to the ATM, don't leave your car running or unlocked. And never leave ATM or other credit cards in your car's glove compartment.

- When using an indoor ATM that requires your card for access, avoid letting unknown people in with you.

What You Can Do

Pre-plan Your Cash Needs & Reduce Your Risk At ATMs

What You Can Do

Pre-plan your cash needs

Stop at a Truity location to withdraw cash or choose the debit option and cash back when purchasing items at a merchant (choose "Debit" instead of "Credit" as your purchase option).

Reduce your risk at ATMs

- Immediately report all crimes to the automated teller machine operator/owner and to the local law enforcement officials.

- Immediately report a lost or stolen card.

- Be aware of your surroundings and listen to your gut. If the ATM is poorly lit or in a concealed location, or if you're just not feeling comfortable, use another machine. Avoid counting cash or rummaging through personal items while standing at the ATM.

- Guard your PIN. Memorize it and never write it down. Cover the keypad when you enter your PIN, and if you notice suspicious activity, cancel your transaction. You should also take your receipt with you, as it may contain personal information that could be helpful to identity thieves.

- When using a drive-through ATM, lock car doors and roll up other windows. If you walk up to the ATM, don't leave your car running or unlocked. And never leave ATM or other credit cards in your car's glove compartment.

- When using an indoor ATM that requires your card for access, avoid letting unknown people in with you.

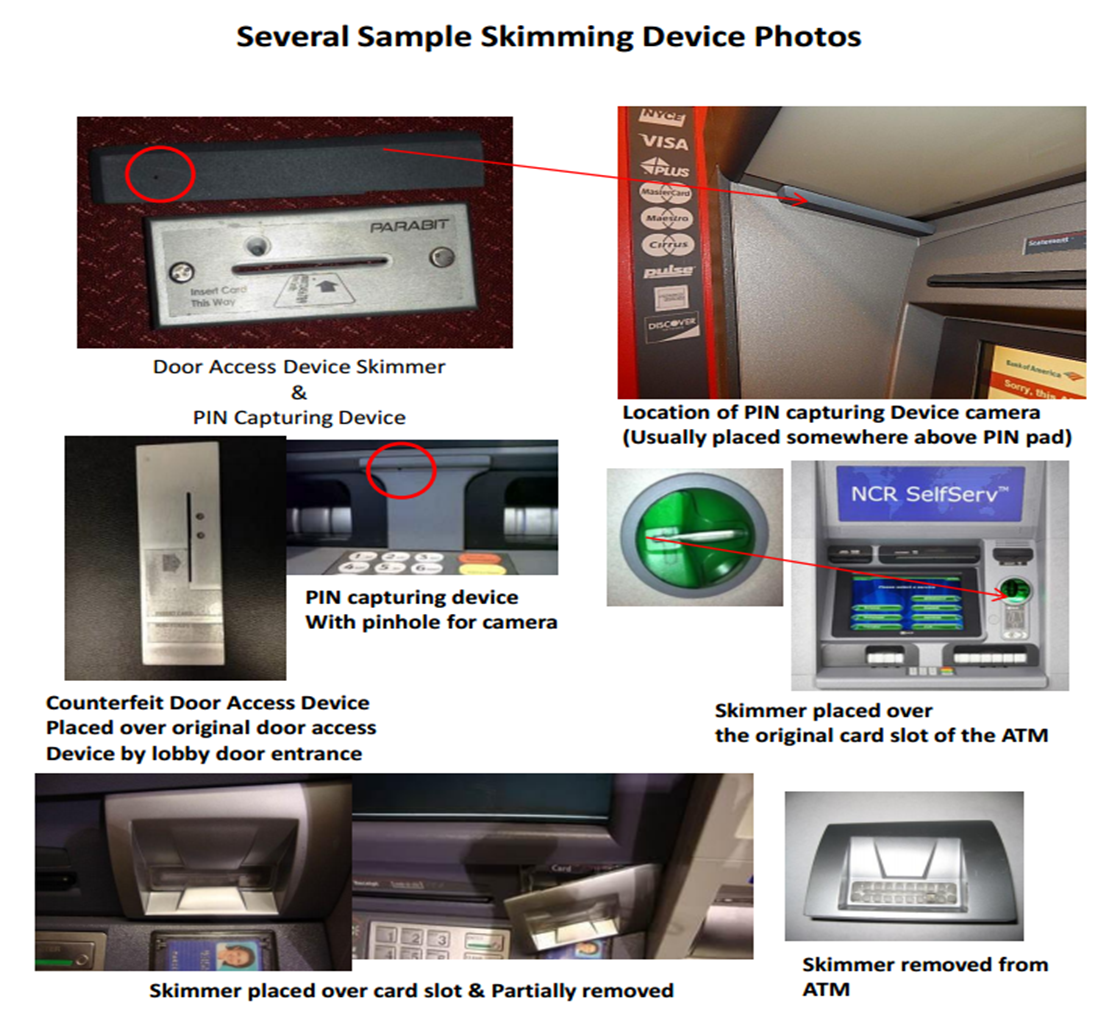

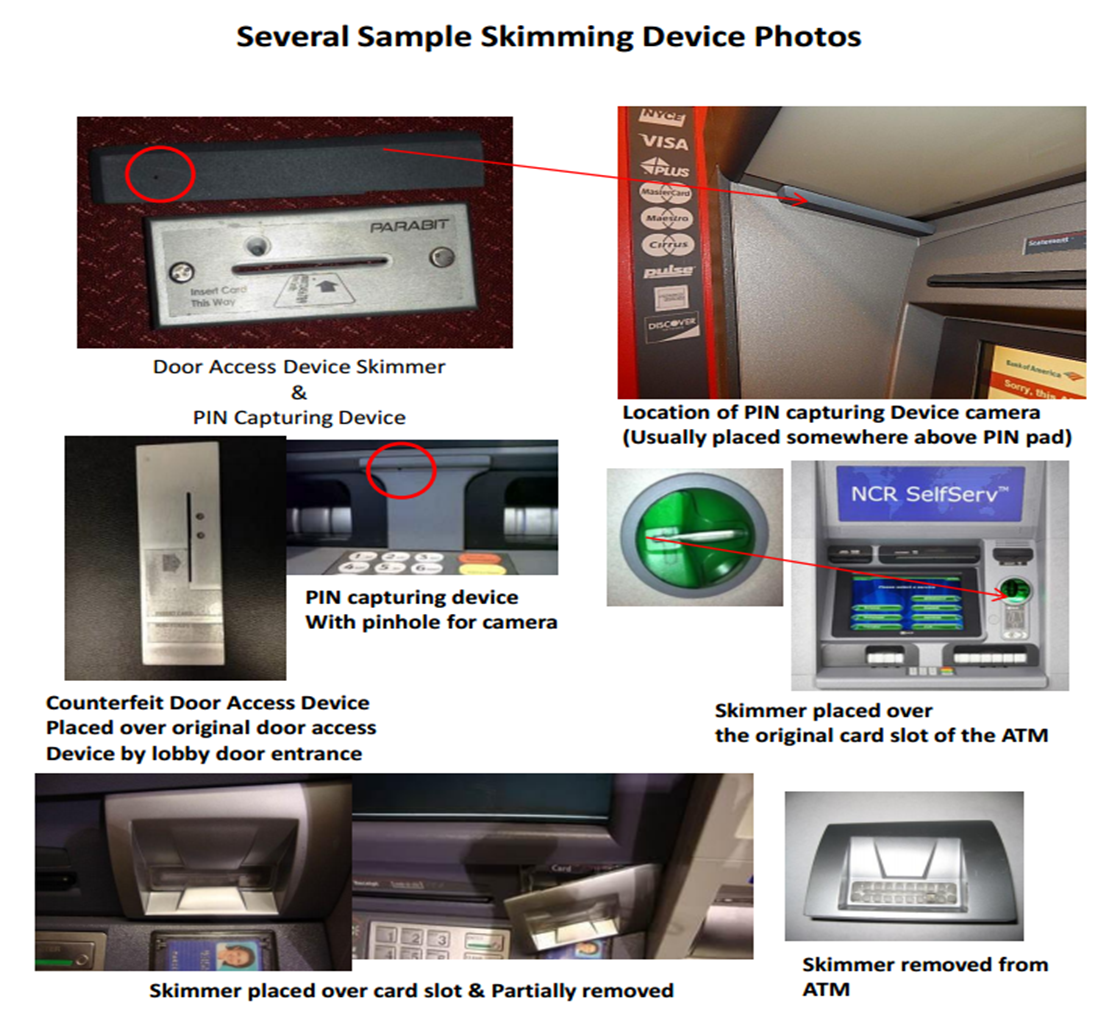

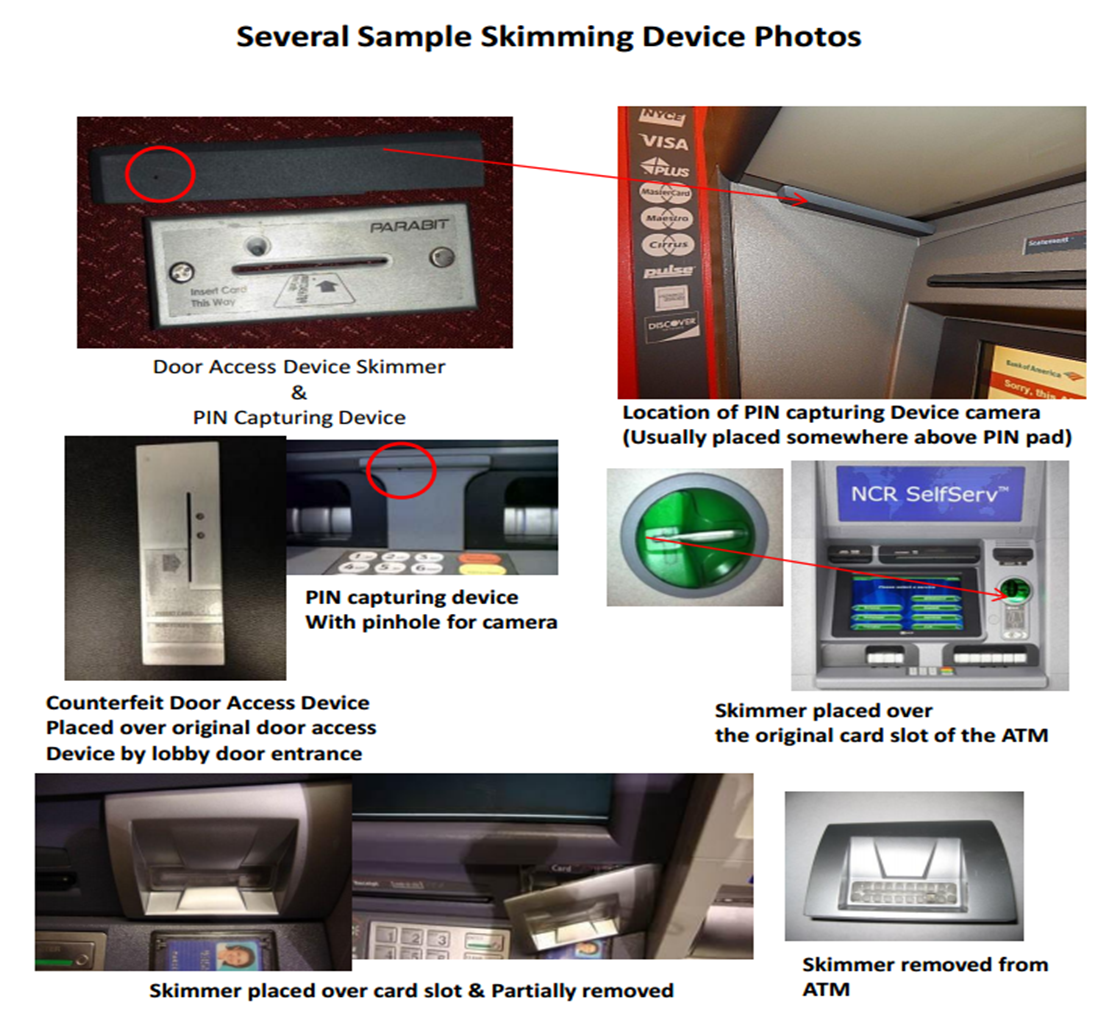

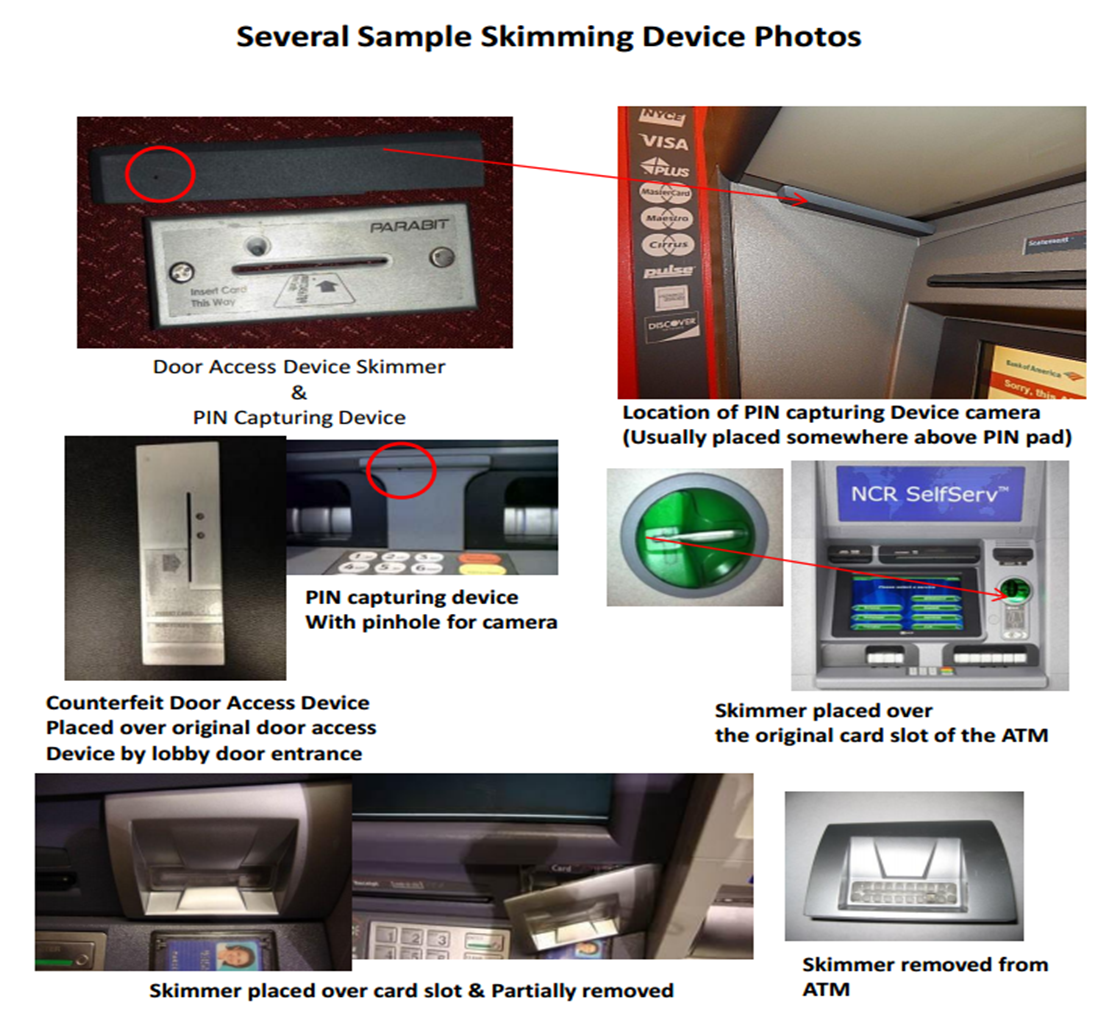

Types of Fraud

ATM Skimming

ATM Skimming involves the attachment of electronic devices on or around the ATM for the purposes of capturing both the magnetic strip data contained on the back of a debit card as well as the PIN number that is entered by the customer when using the ATM. The devices used to capture the information will vary in shapes, sizes and designs but are made to be unobtrusive or mimic legitimate devices.

Reduce the risk of being a victim of ATM Skimming:

- Inspect the ATM for items that were installed over or around the PIN pad. Look for an attachment on the ATM that contains a small PIN hole that is pointed in the direction of the PIN pad.

- Lightly tug the area of the card slot. Most skimming devices are attached with double sided tape for quick removal by the crooks.

- Cover the keypad with your other hand while typing your PIN. This is the best way to ensure that your PIN number is not recorded by a PIN Capturing Device!

The following indicators may indicate ATM skimming activity is or has occurred at the location and should be reported to the ATM owner and the local police department:

- Card slot of the ATM is loose or has fallen off, or other parts of the ATM machine have dislodged from the ATM.

- The presence of double sided tape on the ATM machine or presence of glue or pry marks around the card slot of the ATM.

- If the door access device at the lobby door has been removed or is not securely attached to the wall.

- Observation of person(s) attaching or removing or tampering with parts of the ATM machine.

- Subjects who are using the ATM and are intentionally covering their faces to avoid being depicted (ex. ski masks, hats, scarfs and sunglasses during nighttime use at the ATM).

- Person(s) using multiple cards one after another in order to withdraw funds from an ATM (may be using counterfeit cards from a skimming incident).

- Subjects spending long periods of time outside ATM machines but not conducting transactions.

Types of Fraud

ATM Skimming

ATM Skimming involves the attachment of electronic devices on or around the ATM for the purposes of capturing both the magnetic strip data contained on the back of a debit card as well as the PIN number that is entered by the customer when using the ATM. The devices used to capture the information will vary in shapes, sizes and designs but are made to be unobtrusive or mimic legitimate devices.

Reduce the risk of being a victim of ATM Skimming:

- Inspect the ATM for items that were installed over or around the PIN pad. Look for an attachment on the ATM that contains a small PIN hole that is pointed in the direction of the PIN pad.

- Lightly tug the area of the card slot. Most skimming devices are attached with double sided tape for quick removal by the crooks.

- Cover the keypad with your other hand while typing your PIN. This is the best way to ensure that your PIN number is not recorded by a PIN Capturing Device!

The following indicators may indicate ATM skimming activity is or has occurred at the location and should be reported to the ATM owner and the local police department:

- Card slot of the ATM is loose or has fallen off, or other parts of the ATM machine have dislodged from the ATM.

- The presence of double sided tape on the ATM machine or presence of glue or pry marks around the card slot of the ATM.

- If the door access device at the lobby door has been removed or is not securely attached to the wall.

- Observation of person(s) attaching or removing or tampering with parts of the ATM machine.

- Subjects who are using the ATM and are intentionally covering their faces to avoid being depicted (ex. ski masks, hats, scarfs and sunglasses during nighttime use at the ATM).

- Person(s) using multiple cards one after another in order to withdraw funds from an ATM (may be using counterfeit cards from a skimming incident).

- Subjects spending long periods of time outside ATM machines but not conducting transactions.

Types of Fraud

ATM Skimming

ATM Skimming involves the attachment of electronic devices on or around the ATM for the purposes of capturing both the magnetic strip data contained on the back of a debit card as well as the PIN number that is entered by the customer when using the ATM. The devices used to capture the information will vary in shapes, sizes and designs but are made to be unobtrusive or mimic legitimate devices.

Reduce the risk of being a victim of ATM Skimming:

- Inspect the ATM for items that were installed over or around the PIN pad. Look for an attachment on the ATM that contains a small PIN hole that is pointed in the direction of the PIN pad.

- Lightly tug the area of the card slot. Most skimming devices are attached with double sided tape for quick removal by the crooks.

- Cover the keypad with your other hand while typing your PIN. This is the best way to ensure that your PIN number is not recorded by a PIN Capturing Device!

The following indicators may indicate ATM skimming activity is or has occurred at the location and should be reported to the ATM owner and the local police department:

- Card slot of the ATM is loose or has fallen off, or other parts of the ATM machine have dislodged from the ATM.

- The presence of double sided tape on the ATM machine or presence of glue or pry marks around the card slot of the ATM.

- If the door access device at the lobby door has been removed or is not securely attached to the wall.

- Observation of person(s) attaching or removing or tampering with parts of the ATM machine.

- Subjects who are using the ATM and are intentionally covering their faces to avoid being depicted (ex. ski masks, hats, scarfs and sunglasses during nighttime use at the ATM).

- Person(s) using multiple cards one after another in order to withdraw funds from an ATM (may be using counterfeit cards from a skimming incident).

- Subjects spending long periods of time outside ATM machines but not conducting transactions.

Types of Fraud

Reduce The Risk Of Being A Victim Of ATM Skimming

Types of Fraud

ATM Skimming

ATM Skimming involves the attachment of electronic devices on or around the ATM for the purposes of capturing both the magnetic strip data contained on the back of a debit card as well as the PIN number that is entered by the customer when using the ATM. The devices used to capture the information will vary in shapes, sizes and designs but are made to be unobtrusive or mimic legitimate devices.

Reduce the risk of being a victim of ATM Skimming:

- Inspect the ATM for items that were installed over or around the PIN pad. Look for an attachment on the ATM that contains a small PIN hole that is pointed in the direction of the PIN pad.

- Lightly tug the area of the card slot. Most skimming devices are attached with double sided tape for quick removal by the crooks.

- Cover the keypad with your other hand while typing your PIN. This is the best way to ensure that your PIN number is not recorded by a PIN Capturing Device!

The following indicators may indicate ATM skimming activity is or has occurred at the location and should be reported to the ATM owner and the local police department:

- Card slot of the ATM is loose or has fallen off, or other parts of the ATM machine have dislodged from the ATM.

- The presence of double sided tape on the ATM machine or presence of glue or pry marks around the card slot of the ATM.

- If the door access device at the lobby door has been removed or is not securely attached to the wall.

- Observation of person(s) attaching or removing or tampering with parts of the ATM machine.

- Subjects who are using the ATM and are intentionally covering their faces to avoid being depicted (ex. ski masks, hats, scarfs and sunglasses during nighttime use at the ATM).

- Person(s) using multiple cards one after another in order to withdraw funds from an ATM (may be using counterfeit cards from a skimming incident).

- Subjects spending long periods of time outside ATM machines but not conducting transactions.